How the New Income Tax Regime is Better Than the Old Income Tax Regime

Table of Contents

Income tax planning is a key financial activity for salaried individuals and business owners alike. In India, taxpayers have the option to choose between the Old Income Tax Regime, which includes various exemptions and deductions, and the New Income Tax Regime, introduced from FY 2020-21, which offers lower tax rates but does away with many deductions. Comparing both regimes thoroughly can help you decide which suits you best. This article explains why the new income tax regime is considered better than the old regime for many taxpayers.

1. Lower Tax Rates and Simplified Slabs

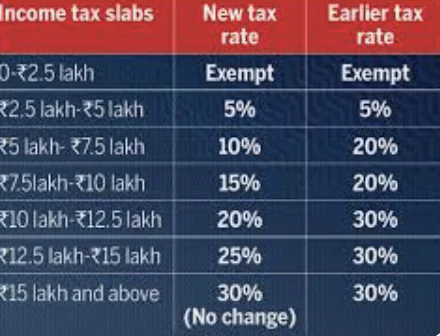

The New Income Tax Regime offers significantly reduced tax rates across multiple slabs compared to the old system. For instance, the highest marginal tax rate is 30% but applies at higher slabs, and the rates for lower income slabs are reduced.

| Income Slab (INR) | Old Regime Tax Rate | New Regime Tax Rate |

| Up to ₹2.5 lakh | NIL | NIL |

| ₹2,50,001 – ₹5 lakh | 5% | 5% |

| ₹5,00,001 – ₹7.5 lakh | 20% | 10% |

| ₹7,50,001 – ₹10 lakh | 20% | 15% |

| ₹10,00,001 – ₹12.5 lakh | 30% | 20% |

| ₹12,50,001 – ₹15 lakh | 30% | 25% |

| Above ₹15 lakh | 30% | 30% |

This flatter and lower tax rate structure makes the new regime attractive, especially for middle-income taxpayers.

2. No Need to Keep Track of Numerous Exemptions and Deductions

One of the biggest advantages of the new regime is the elimination of the need to maintain evidence or documentation for a range of exemptions and deductions like:

- House Rent Allowance (HRA)

- Leave Travel Allowance (LTA)

- Standard Deduction (₹50,000)

- Investment deductions under Section 80C (up to ₹1.5 lakh)

- Deductions for health insurance (Section 80D), education loan interest (Section 80E), etc.

The simplification reduces the compliance burden, saves time, and minimizes chances of error during tax filing.

3. Encourages Transparent Income and Spending Patterns

The new regime promotes transparency as taxpayers declare their gross income without bothering about structuring salary or investments to claim exemptions. This can lead to better financial planning and encourages earning and spending without complex tax planning.

4. Flexibility to Switch Between Regimes

Taxpayers have the option to choose between the old and new regimes every financial year (for individuals without business income), allowing flexibility to opt for whichever is beneficial given their income and investments. Previously, taxpayers had to commit for longer periods.

5. Suitable for Taxpayers Without Major Investments or Exemptions

If you do not have significant tax-saving investments or do not utilize many exemptions, the new regime generally results in lower tax liability because you benefit from reduced tax rates directly without the need to invest.

6. Streamlining of Tax Filing Process

Because the new regime reduces complexities, tax filing systems and processes have been streamlined to accommodate faster filing and quicker refunds where due.

7. Encourages Savings and Investments Unbiased by Tax Breaks

The old regime induced investment decisions primarily based on tax savings. The new regime allows individuals to select investments based on actual financial goals rather than just tax benefits.

Points to Consider While Comparing

| Factor | Old Regime | New Regime |

| Tax Rates | Higher slippered tax rates | Lower flat tax rates |

| Exemptions and Deductions | Multiple allowed (Section 80C, HRA, etc.) | Nil allowed except NPS contribution and employer contribution under Section 80CCD(2) |

| Compliance Burden | Higher due to tracking documents | Lower due to fewer claims |

| Best For | Taxpayers with significant investments and exemptions | Taxpayers with few or no investments/deductions |

| Flexibility | Only selectable at the start of employment or business | Annual option for salaried individuals |

Conclusion: Why the New Income Tax Regime is Better

- Offers lower tax rates making it beneficial for many salaried individuals and professionals.

- Removes the burden of tracking multiple deductions and exemptions.

- Simplifies tax filing with a transparent income declaration.

- Provides the flexibility to switch between regimes year-on-year.

- Encourages focusing on genuine investments rather than tax-saving instruments.

While the old regime may still benefit some taxpayers with substantial eligible deductions, the new income tax regime is designed for simplicity, transparency, and relief from complex tax compliance. Evaluating your income, investments, and tax-saving needs alongside this comparison can help you make an informed choice.